Your all-in-one banking SaaS solutions and innovative payment services

For more than 15 years in banking, we’ve seen what works and what doesn’t. The banking solutions that helped us and our fintechs partners succeed, we’ve improved to help you grow. Our all-in-one banking SaaS platform and innovative banking SaaS platform make it easy for you to manage your payment processing, analytics, and core banking easily.

The banking

solutions

that are built to grow your business

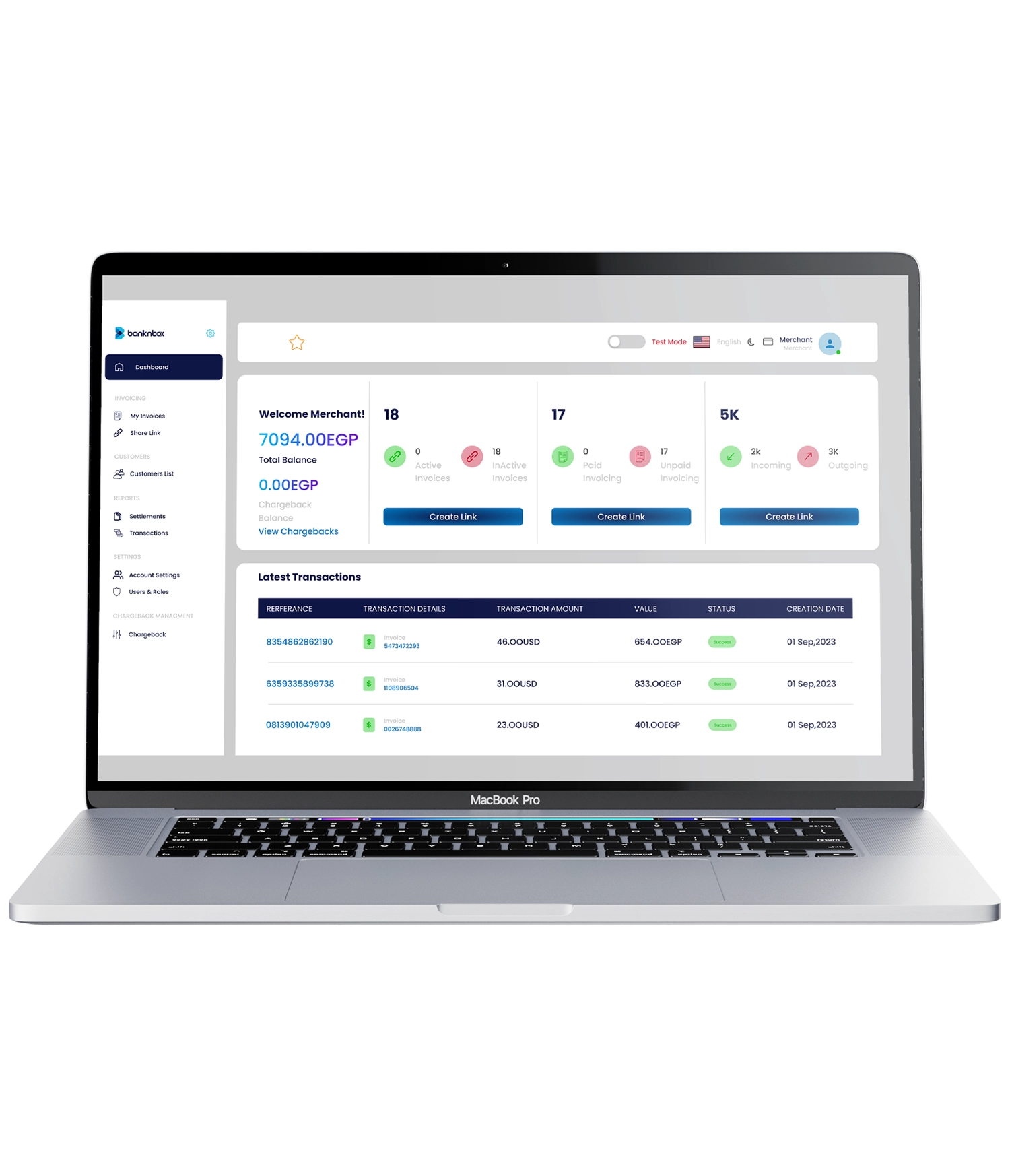

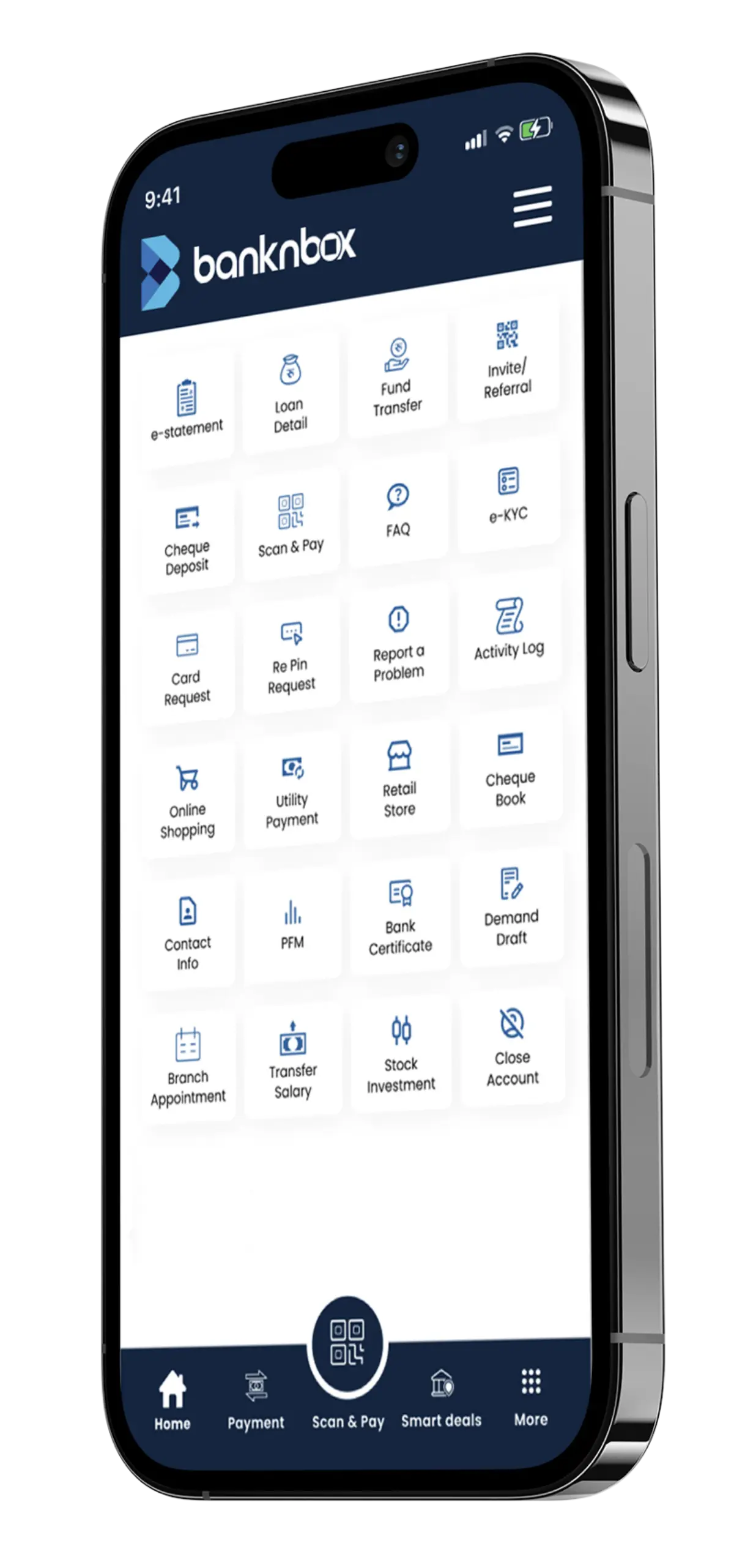

Digital Banking Platform Solutions

Our scalable digital banking ecosystem includes core banking SaaS, internet banking platforms, and mobile banking solutions. Perfect for banks looking to modernize their digital banking infrastructure with white label banking software and online banking solutions.

Card issuing solutions and processing

services for banks

Looking for an easy way to manage all your cards? Our card issuing solutions and processing platform helps banks and fintechs handle prepaid, credit, debit, virtual, and gift cards easily. With built-in fraud detection, 3D Secure, rewards programs, and real-time transaction monitoring, our card management platform makes operations smoother, safer, and more efficient—helping you deliver the best banking solutions to your customers.

Card acquiring services for businesses

With our acquiring services, banks, fintechs, and merchants can handle cashless payments anywhere whether in-store, online, or via mobile POS. Our platform is backed by the latest technology and security, so you can offer complete, scalable acquiring solutions that keep your business running smoothly and your customers happy.

Value Added Services

Backed with the latest technology & security infrastructure to offer end-to-end different cashless payment solutions either in-store, online or a mobile POS to help banks, FinTech’s and merchants to offer complete and robust acquiring solutions.

Get in Touch with Banknbox?

Ready to transform your banking services with our white label digital banking solutions?

Contact us today to learn more about our Banking Solutions, card issuing solutions, and SaaS banking services.