Your all-in-one banking SaaS solutions

and innovative payment services

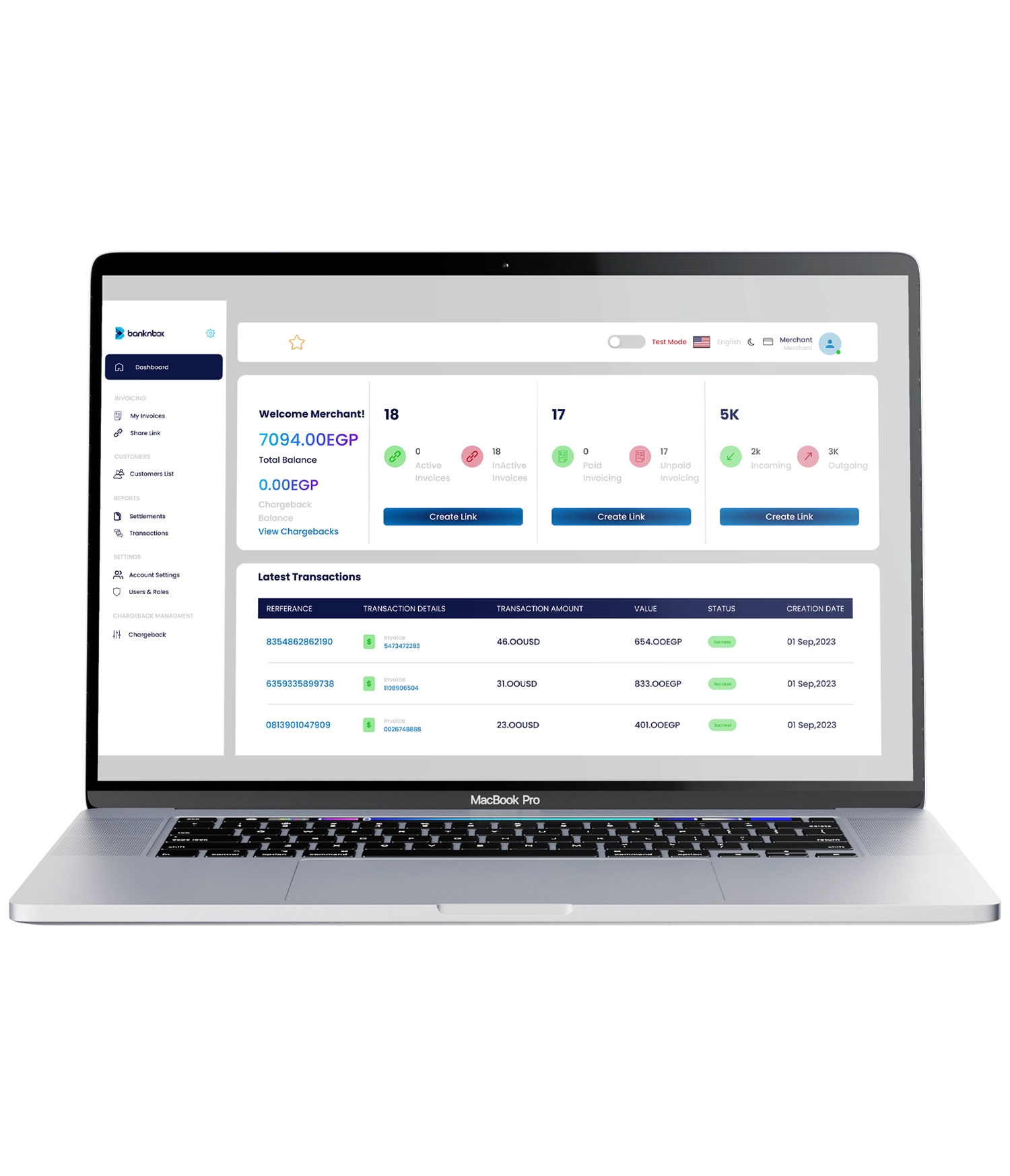

For over 15 years in banking, we’ve seen what works and what doesn’t. The bankings solutions that helped us and our fintechs partners succeed, we’ve improved to help you grow. Our all-in-one banking SaaS platform and innovative banking SaaS platform make it easy for you to manage your payment processing, analytics, and core banking easily.

The banking solutions

that are built to grow your business

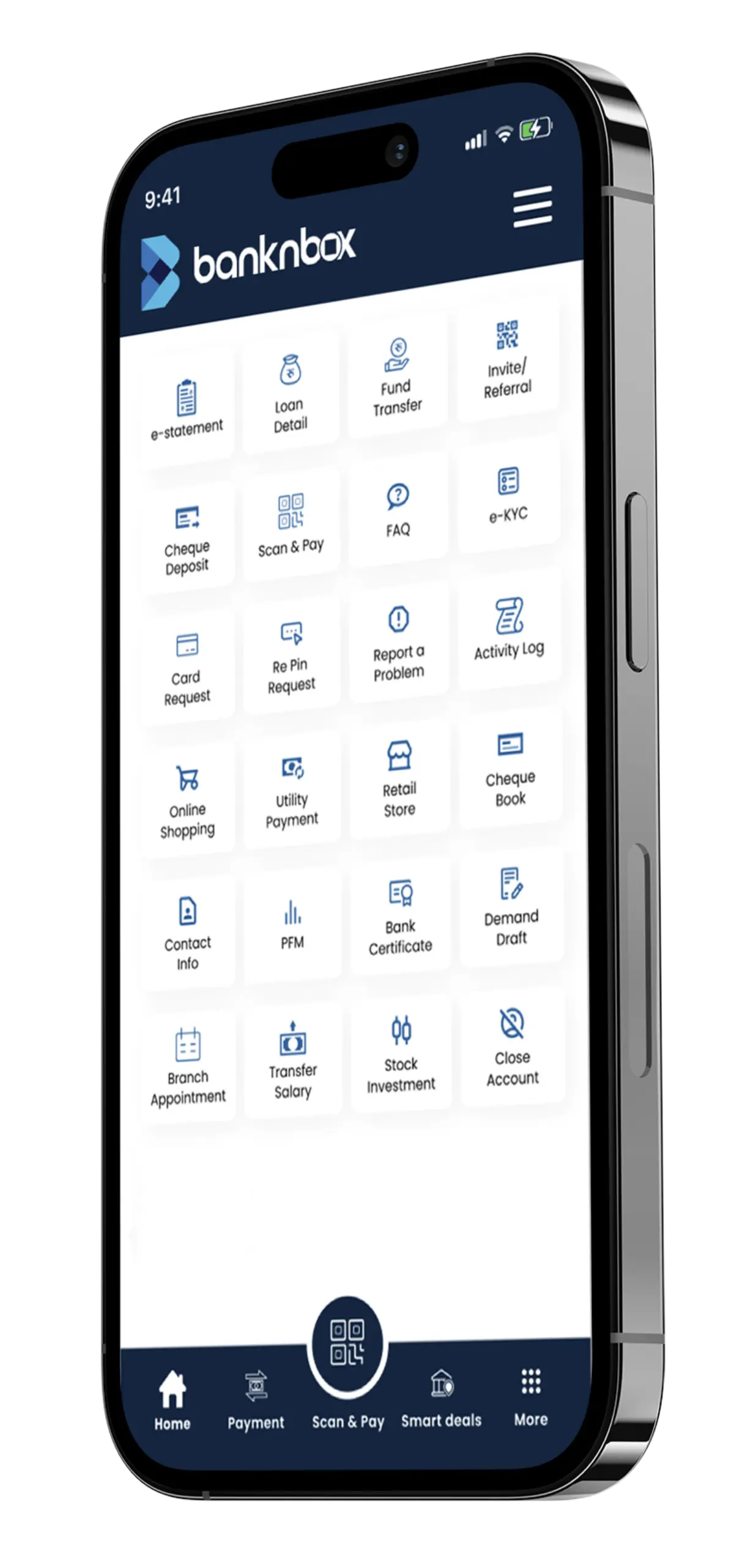

Digital Banking Platform Solutions

Our scalable digital banking ecosystem includes core banking SaaS, internet banking platforms, and mobile banking solutions. Perfect for banks looking to modernize their digital banking infrastructure with white label banking software and online banking solutions.

Card issuing solutions and processing

services for banks

Looking for an easy way to manage all your cards? Our card issuing solutions and processing platform helps banks and fintechs handle prepaid, credit, debit, virtual, and gift cards easily. With built-in fraud detection, 3D Secure, rewards programs, and real-time transaction monitoring, our card management platform makes operations smoother, safer, and more efficient—helping you deliver the best banking solutions to your customers.

Card acquiring services for businesses

With our acquiring services, banks, fintechs, and merchants can handle cashless payments anywhere whether in-store, online, or via mobile POS. Our platform is backed by the latest technology and security, so you can offer complete, scalable acquiring solutions that keep your business running smoothly and your customers happy.

Value Added Services

Backed with the latest technology & security infrastructure to offer end-to-end different cashless payment solutions either in-store, online or a mobile POS to help banks, FinTech’s and merchants to offer complete and robust acquiring solutions.

What is a digital banking ecosystem?

How does core banking SaaS work?

What makes a modular banking platform better?

Why choose a SaaS wallet platform?

What is the difference between Open Banking and Banking as a Service?

How does Banknbox compare to other banking solutions?

What security features are included in core banking solutions?

Can banking solutions integrate with existing systems?

What support comes with SaaS banking platforms?

How quickly can digital banks launch with modern banking solutions?

Get in Touch with BankNBox?

Ready to transform your banking services with our white label digital banking solutions?

Contact us today to learn more about our Banking Solutions, card issuing solutions, and SaaS banking services.